China’s telecommunication industry is dominated by three state-owned mobile operators: China Mobile, China Unicom, and China Telecom. These companies are responsible for providing mobile and fixed-line telecommunications services to hundreds of millions of people across the country. In recent years, the rise of 5G technology and the introduction of eSIM cards have brought significant changes to the landscape of China’s mobile operators.

China Mobile: The Largest Mobile Operator in China

China Mobile is the largest mobile operator in China, with over 940 million subscribers as of June 2023. It dominates both the mobile and fixed-line markets, with a market share of 56%. Headquartered in Beijing, China Mobile provides a wide range of telecommunications services, including voice, data, messaging, and multimedia services.

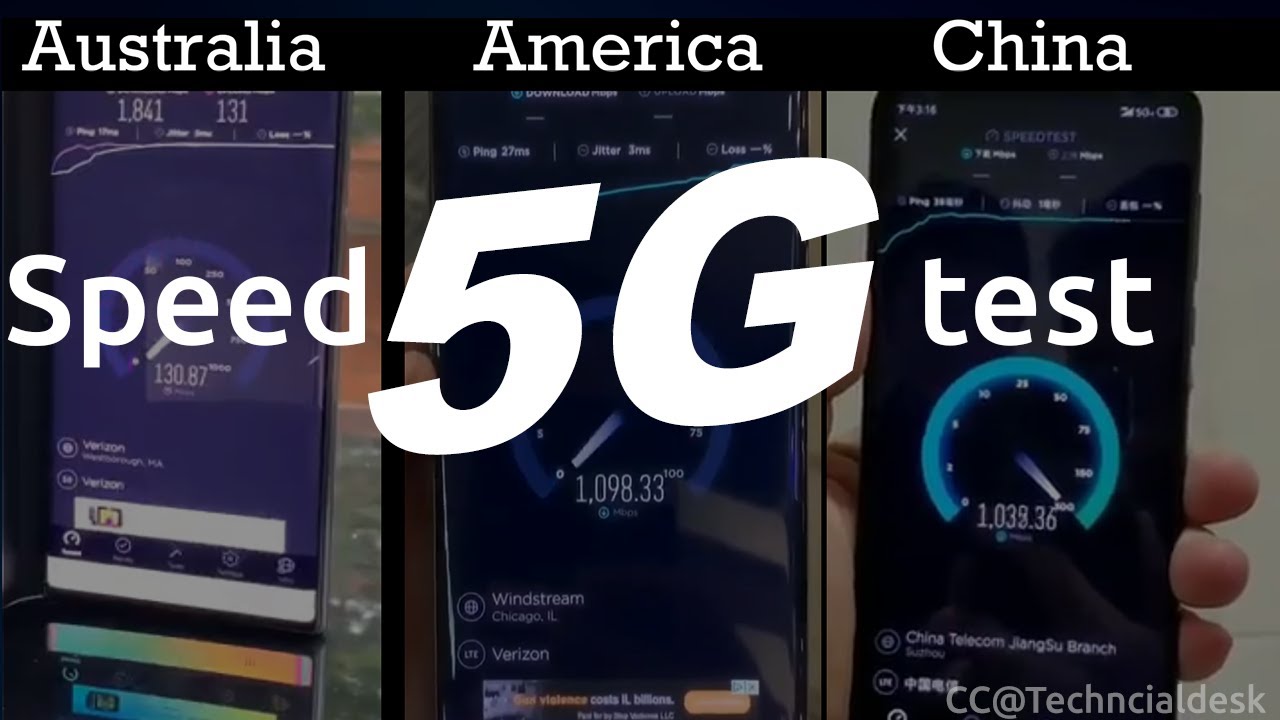

The company has also been at the forefront of 5G technology development and deployment in China. As of June 2023, China Mobile has launched 5G networks in over 300 cities across the country, covering more than 90% of the population. Its 5G network has been widely praised for its speed and reliability, which has significantly improved the user experience for its subscribers.

China Unicom: A Major Player in the Chinese Telecom Industry

China Unicom is another major player in China’s telecom industry, with a market share of around 22%. Headquartered in Beijing, China Unicom offers a wide range of mobile and fixed-line services, including voice, data, messaging, and multimedia services. As of June 2023, the company has over 270 million mobile subscribers.

While China Unicom has not been as active in 5G rollout as China Mobile, it has made significant progress in this area in recent years. It has launched 5G networks in more than 100 cities across the country, covering more than 70% of the population. China Unicom has also made significant investments in cloud computing, big data, and other emerging technologies to stay competitive in the market.

China Telecom: Providing Telecommunications Services Nationwide

China Telecom is the third-largest mobile operator in China, with a market share of around 22%. Headquartered in Beijing, China Telecom provides mobile and fixed-line telecommunications services to millions of people across the country. As of June 2023, the company has over 300 million subscribers.

Similar to China Unicom, China Telecom has been actively deploying 5G networks across the country. As of June 2023, it has launched 5G networks in more than 200 cities, covering more than 80% of the population. The company has also invested heavily in cloud computing and other cutting-edge technologies to enhance its service offerings and improve the user experience for its customers.

The Competitive Landscape of China’s Mobile Operators

The Chinese telecom market is highly competitive, with numerous players vying for market share. In addition to the three major state-owned operators, there are several smaller players, including China Broadcasting Network (CBN) and China Tower.

Despite the intense competition, China Mobile, China Unicom, and China Telecom have maintained their dominant positions in the market due to their extensive network coverage, advanced technology, and strong brand recognition. However, the emergence of new technologies such as 5G and eSIM cards is changing the dynamics of the market and creating new opportunities for smaller players to gain a foothold.

5G Rollout in China: Impact on Mobile Operators

The rollout of 5G technology in China is having a significant impact on the mobile operator market. The increased speed and bandwidth offered by 5G networks are enabling new applications and services that were not possible with previous generations of technology.

For example, 5G networks can support virtual reality (VR) and augmented reality (AR) applications, which have the potential to revolutionize industries such as healthcare, education, and entertainment. 5G networks can also support the Internet of Things (IoT), enabling millions of devices to communicate with each other in real-time.

Mobile operators are investing heavily in 5G technology to stay competitive and take advantage of these new opportunities. China Mobile, China Unicom, and China Telecom have all launched 5G networks across the country and are actively promoting 5G-enabled services to their customers.

Does eSIM work in China?

eSIM cards are a relatively new technology that allows users to activate a mobile plan without using a physical SIM card. Instead, the user’s phone is embedded with a small chip that can be programmed to connect to a specific network.

While eSIM technology has been widely adopted in many countries around the world, its use in China has been limited due to regulatory restrictions. Currently.

However, there are signs that this may change in the near future. The Chinese government has expressed interestin promoting eSIM technology as part of its efforts to build a more efficient and convenient mobile communications system. In 2021, Chinese authorities announced plans to promote the use of eSIM cards in the country by establishing a national policy on their use.

The adoption of eSIM technology in China is expected to increase in the coming years as more mobile operators begin to support it and as the government promotes its use. However, it is important to note that there are still regulatory restrictions in place that could limit the widespread adoption of eSIM technology in China.

Good news! As a tourist, you can still purchase and use an esim in China. You can buy travel esim packages at chinaesim.com.

China’s Mobile Operators and Their International Expansion Strategies

In recent years, China’s mobile operators have been looking beyond their domestic market and expanding their operations overseas. This is part of a broader strategy by the Chinese government to increase China’s global influence and expand its reach into international markets.

China Mobile, China Unicom, and China Telecom have all established partnerships with foreign telecom operators and invested in overseas markets. For example, China Mobile has invested heavily in developing 5G networks in countries such as Pakistan and Malaysia, while China Unicom has partnered with telecom operators in countries such as Brazil and Mexico.

These international expansion efforts have not been without challenges, however. Some countries have raised concerns about the security implications of Chinese telecom companies operating in their markets, leading to increased scrutiny and regulatory restrictions.

Regulatory Environment for China’s Mobile Operators

As state-owned enterprises, China Mobile, China Unicom, and China Telecom are subject to extensive regulation by the Chinese government. The regulatory environment for these companies is complex and often opaque, with regulations changing frequently and sometimes with little warning.

One key area of regulation that has affected China’s mobile operators in recent years is data privacy and security. The Chinese government has implemented new regulations aimed at protecting user data and preventing cyber attacks. These regulations have placed new requirements on mobile operators to ensure the security of their networks and customer information.

In addition to domestic regulations, China’s mobile operators are also subject to regulatory scrutiny in overseas markets. As mentioned above, some countries have raised concerns about the security implications of Chinese telecom companies operating in their markets.

Recent Developments in China’s Mobile Operator Market

The Chinese mobile operator market is constantly evolving, with new technologies and services being introduced regularly. In recent years, there have been several notable developments in this market.

One key development has been the rise of mobile payments. China’s mobile payment market has grown rapidly in recent years, driven by the popularity of apps such as Alipay and WeChat Pay. These apps allow users to make payments for a wide range of goods and services, from groceries to taxi rides.

Another significant development has been the increasing focus on cloud computing and artificial intelligence (AI). China’s mobile operators have invested heavily in cloud computing infrastructure and AI technology, which has enabled them to offer new services such as voice recognition and natural language processing.

Technological Advances Driving Growth in China’s Mobile Operator Market

The growth of China’s mobile operator market is being driven by several technological advances, including 5G, eSIM, mobile payments, and cloud computing. These technologies are enabling new applications and services that are transforming the way people communicate and access information.

For example, 5G networks are enabling new applications such as remote surgery and autonomous vehicles, while eSIM technology is making it easier for users to switch between mobile carriers and devices. Mobile payments are revolutionizing the way people make transactions, while cloud computing and AI are enabling new services such as voice assistants and smart homes.

Future Outlook for China’s Mobile Operators

The future outlook for China’s mobile operators is positive, with continued growth expected in the coming years. The adoption of 5G technology is expected to accelerate, driving increased demand for advanced services and applications. eSIM technology is also expected to become more widely adopted, further expanding the market for mobile services.

However, there are also challenges facing China’s mobile operators, including increasing competition from new entrants and regulatory uncertainties. These challenges will require mobile operators to remain agile and innovative in order to stay competitive and meet the evolving needs of their customers.

Conclusion

China’s mobile operator market is a complex and rapidly evolving industry that is being transformed by new technologies and changing regulatory environments. The three state-owned mobile operators, China Mobile, China Unicom, and China Telecom, dominate the market, but face increasing competition from smaller players and overseas markets.

The adoption of 5G technology and eSIM cards is driving growth in the market, while mobile payments, cloud computing, and AI are enabling new services and applications. The future outlook for China’s mobile operators is positive, but challenges remain, including increasing competition and changing regulatory environments.

Overall, China’s mobile operator market is an important and dynamic part of China’s economy, and will continue to play a key role in shaping the country’s technological and social landscape in the coming years.